INSIDE POLITCS REPORTER

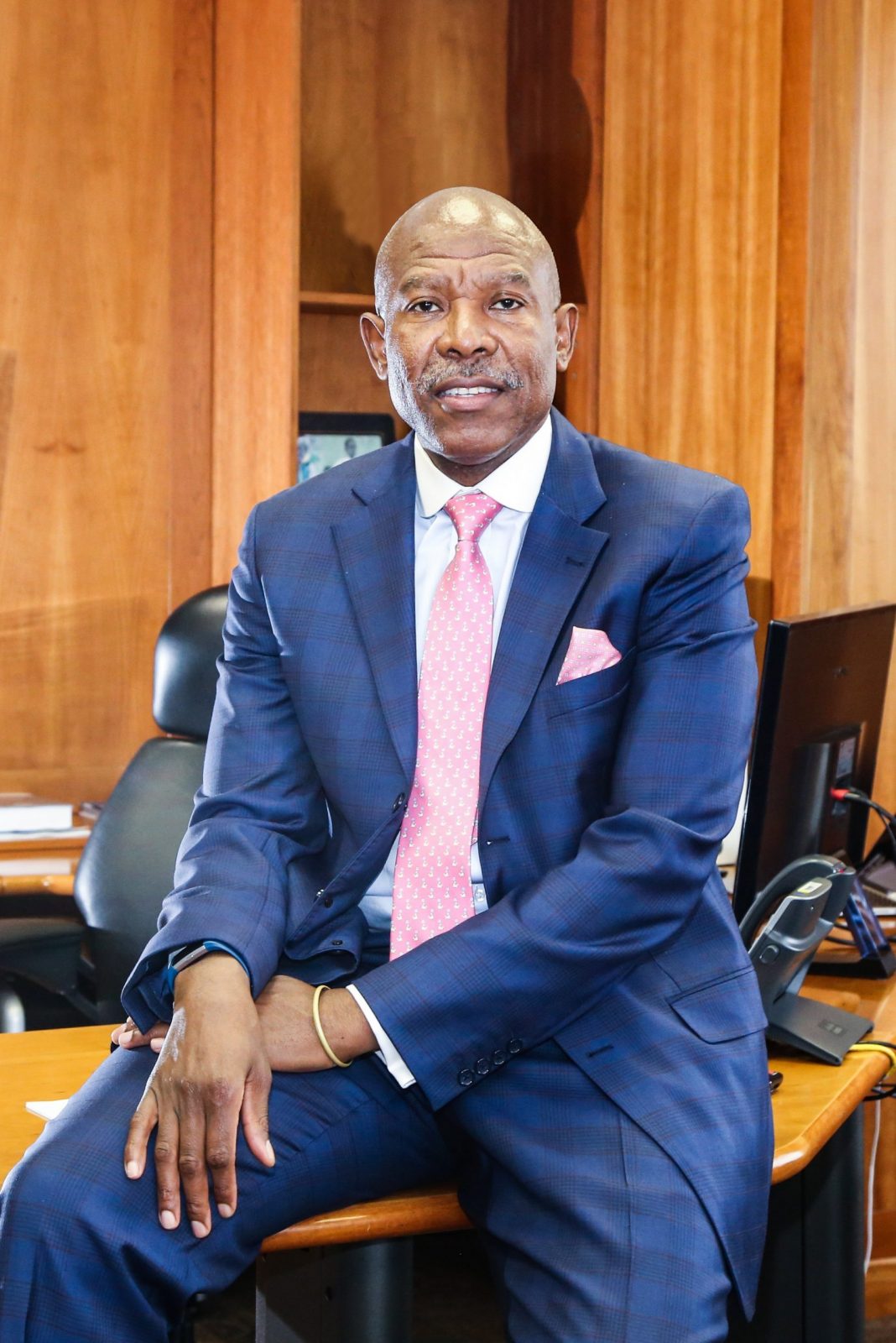

THE South African financial system remains resilient despite the impact of the lockdown caused by the COVID-19 pandemic, South African Reserve Bank Governor Lesetja Kganyago said during a webinar of the launch of the bank’s semi-annual Financial Stability Review (FSR).

“The banks are stronger and more resilient than they were in 2008 as their liquidity and solvency ratios are better than they were then,” Kganyago said in reference to the 2008 Global Financial Crisis, which triggered the great recession.

Over the past decade, financial regulation has been enhanced, which has meant that banks have significant buffers in place to absorb shocks. For example, the total capital adequacy ratio (CAR) of the banking sector has increased by more than a third since 2008. In the period since, South Africa has since adopted the Basel III regulatory framework.

The regulations are also enhanced by regular stress tests that check to see whether the banks’ buffers are big enough to absorb a shock.

The last stress test was in 2018 and included two severe but plausible macroeconomic scenarios and was conducted on the six largest banks.

One scenario assumed a sharp recession and a relatively rapid recovery, the so-called ‘V-shaped scenario, with GDP growth over the four worst consecutive quarters of the scenario averaging -4.8%.

The other scenario modelled a longer but shallower downturn (the so-called ‘L-shaped scenario’), with a recession that lasted almost three years. Over the three-year horizon for both scenarios, all banks maintained adequate levels of capital without taking mitigating actions.

The FSR said that on average, the banking sector’s capital position is currently similar to where it was when the stress test was conducted.

Although it is difficult to compare the scenarios in the stress test with the current economic projections, the stress test results do highlight the resilience of the banking sector to a severe shock.

The SARB has taken measures to ensure that financial markets function effectively, and credit provision continues, and the central bank says it stands ready to take additional action, should the need arise.

It has cut the repo rate by 275 basis points so far this year and many economists expect further cuts in July and September.

The bank has also started purchasing government bonds on the secondary market and currently hold about R 20.6 billion worth of these.

The FSR said the lockdown in response to the pandemic would exacerbate the problems of low growth and high unemployment, while also causing a rise in bad debts from households and businesses already struggling after the economy tipped into recession in the second half of 2019 with the SARB currently projecting a 7% decline this year, while several economists see a decrease larger than 10%.

The worst full-year GDP growth performance in South Africa’s post-Second World War history was -2.1% in 1992.

The FSR noted that the projection of a sharp contraction in 2020 and a relatively weak recovery implies that the level of real GDP in 2022 is likely to be lower than that of 2018.

As a result, banks could face challenges rebuilding capital buffers if they are worked down over the coming months.

Should the economic downturn be deeper or more protracted than currently expected, financial stability risks will escalate.

(Compiled by Inside Politics staff)