By Chuck Mikolajczak

U.S. stocks closed slightly lower after a choppy session on Monday, as investors prepared for a crucial week in which Americans will elect a new president and the Federal Reserve will announce its policy statement.

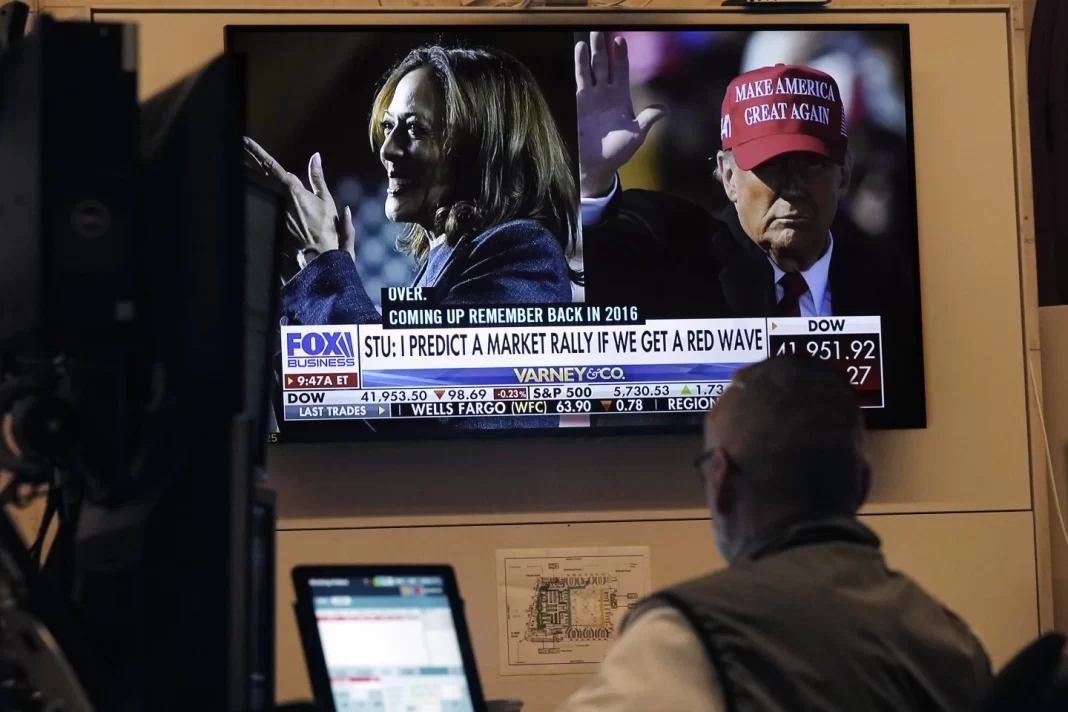

Presidential candidates Donald Trump and Kamala Harris both scrambled for an edge in the last full day of a race that polls show as extremely close. It could take days to determine the victor.

Some of the so-called “Trump trades” unwound after a recent poll showed Harris, the Democratic vice president, leading in Iowa, sparking a drop in the U.S. dollar , Treasury yields and bitcoin. Trump Media & Technology Group closed up 12.37%, bouncing back from early losses of nearly 6%.

In light of the Iowa poll, Harris’ odds against the Republican former president improved on several betting sites, which many market participants eye as election indicators.

“Since we’re going to take until Thursday or so, at least, to figure out who won, unfortunately this is going to be a pretty volatile week,” said Sam Stovall, chief investment strategist at CFRA Research in New York.

“Earnings are going well, the Fed is still likely to cut interest rates, the only true uncertainty is the election, and hopefully that will be finalized sooner rather than later so investors can go back to investing.”

The Dow Jones Industrial Average fell 257.59 points, or 0.61%, to 41,794.60, the S&P 500 lost 16.11 points, or 0.28%, to 5,712.69 and the Nasdaq Composite lost 59.93 points, or 0.33%, to 18,179.98.

The benchmark 10-year Treasury note was last off 6.4 basis points (bps) at 4.299%, after initially dropping as much as 10 bps. Volatile trading is expected until the election is decided, and investors are clearer on government policy. The 10-year yield had fallen for five straight months before surging about 48 bps in October.

Reuters