By Thebe Mabanga

The South African Reserve Bank’s Monetary Policy Committee (MPC) is expected to keep interest rates unchanged on Thursday despite August inflation coming in better than expected.

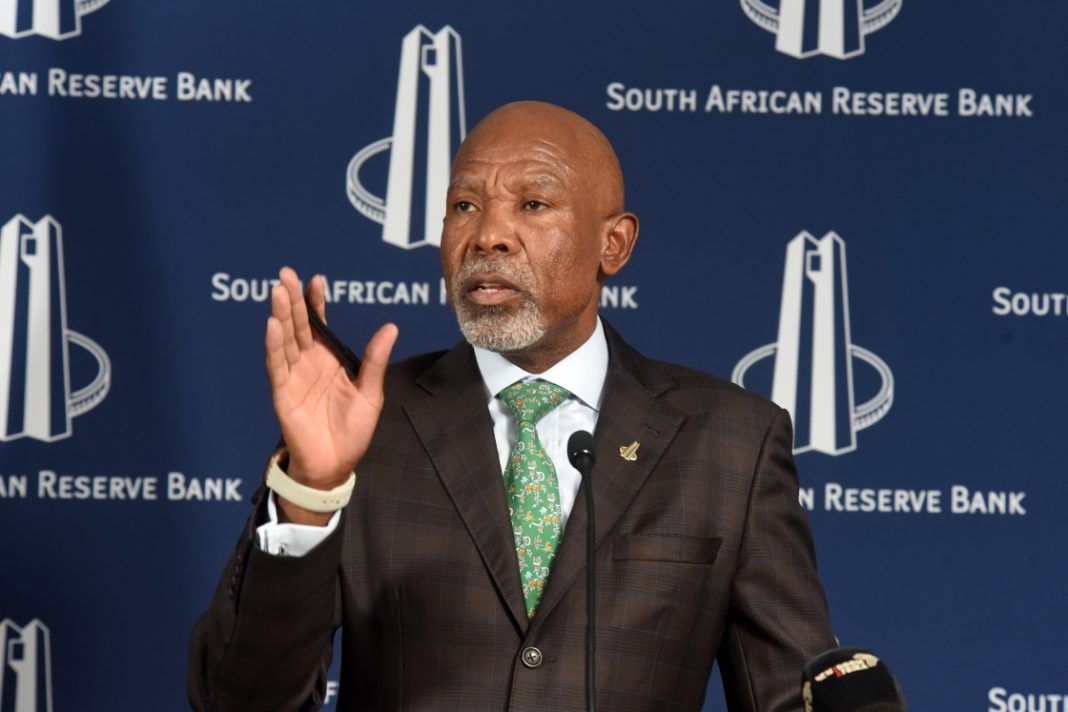

This indicates that Reserve Bank Governor Lesetja Kganyago is likely to continue pushing for lowering the inflation target towards the bottom of the band, even as the National Treasury insists the target remains under review.

“We believe the MPC will leave the repo rate unchanged at this week’s meeting, pausing its easing cycle, which started in September last year,” Nedbank said in a research note issued to investors this week.

“The July meeting was a watershed moment for monetary policy in South Africa, with the MPC taking the initiative to lower its preferred inflation anchor within the existing 3-6% target range from 4.5% to 3%.”

The bank said of Kganyago’s announcement, which it describes as having taken government by surprise.

In the period since, Finance Minister Enoch Godongwana has gone to great lengths to assert his authority on the matter.

First, he issued a statement outlining the role and responsibility of National Treasury and the Reserve Bank in determining the inflation target, insisting that is his prerogative and decision which he then communicates to the Reserve Bank.

He went further as National Treasury and the Reserve Bank issued a joint statement which stated that a joint technical committee is currently reviewing the inflation target and will table its recommendation to leadership of both institutions before the minister makes the final decision.

But all that scramble appears to be in vain as the market now expects Kganyago to stick to his guns and aim for the lower end of the target.

“We support the adoption of a lower target, but the timing of the move complicates our outlook for monetary policy,” Nedbank said.

This is because, prior to the release this week of inflation figures for August, South Africa had endured four months of rising inflation, fuelled in part by rising food inflation, pushed by meat prices which are elevated by the outbreak of foot and mouth disease.

On Wednesday, Statistics South Africa (StatsSA) reported that the Consumer Price Index (CPI) had moderated from 3.5% in July to 3.3% in August, well below market forecast of 3.6%.

Under a more benign Monetary Policy regime this would a signal to continue easing rates but under Kganyago’s hawkish stance coupled with his imposed steeper target, a cut now seems likely.

The MPC prefers the lower target to anchor inflation expectations.

CPI is now expected to peak at 4,5% in 2026 before falling into 2027.

For August, food and non-alcoholic beverages prices slowed and fell from 5.7% year on year to 5.2% after food moderated from 5.5% to 5.2%.

Despite a slowdown in food inflation, meat prices continued to climb from 10.3% to 11.3%, its highest since February 2023 on the back of the foot and mouth outbreak while fruit and vegetables while dairy, milk and eggs declined for the third consecutive month.

Another key driver of inflation in the past quarter was the sharp rise in administered prices, which accelerated from 0.9% in June to 3.7% in July following steep increases in electricity and water tariffs. In August, core inflation—excluding food and energy—ticked up slightly from 3% to 3.1%.

Attention now shifts to Finance Minister Enoch Godongwana, who will present the Medium-Term Budget Policy Statement on 12 November.

He could take a measured approach, highlighting that lower inflation supports the economy and that a reduced inflation target could reinforce fiscal discipline.

Alternatively, he may assert his authority more bluntly, as he did previously when he dismissed SARS Commissioner Edward Kieswetter with the pointed phrase “uhamba nini” (“when are you leaving?”), echoing his exchange with cabinet colleague Khumbudzo Ntshavheni.

Kganyago’s new five-year term as Reserve Bank Governor was confirmed in March last year.

INSIDE POLITICS