Johnathan Paoli

Finance Minister Enoch Godongwana said the weak performance of the South African economy has resulted in a sharp deterioration in tax revenue collection for the past financial year while delivering the 2024 Budget speech on Wednesday at Cape Town City Hall.

Godongwana said the R1.73 trillion tax revenue for 2023/24 was R56.1 billion lower than estimated in the 2023 Budget and the shortfall was largely due to the decline in corporate profits and revenue from taxes on mining.

He said the medium term revenue projections were R45.6 billion higher than the 2023 Mid-Term Budget projection estimates from last year which increased personal income tax and additional medium term revenue proposals.

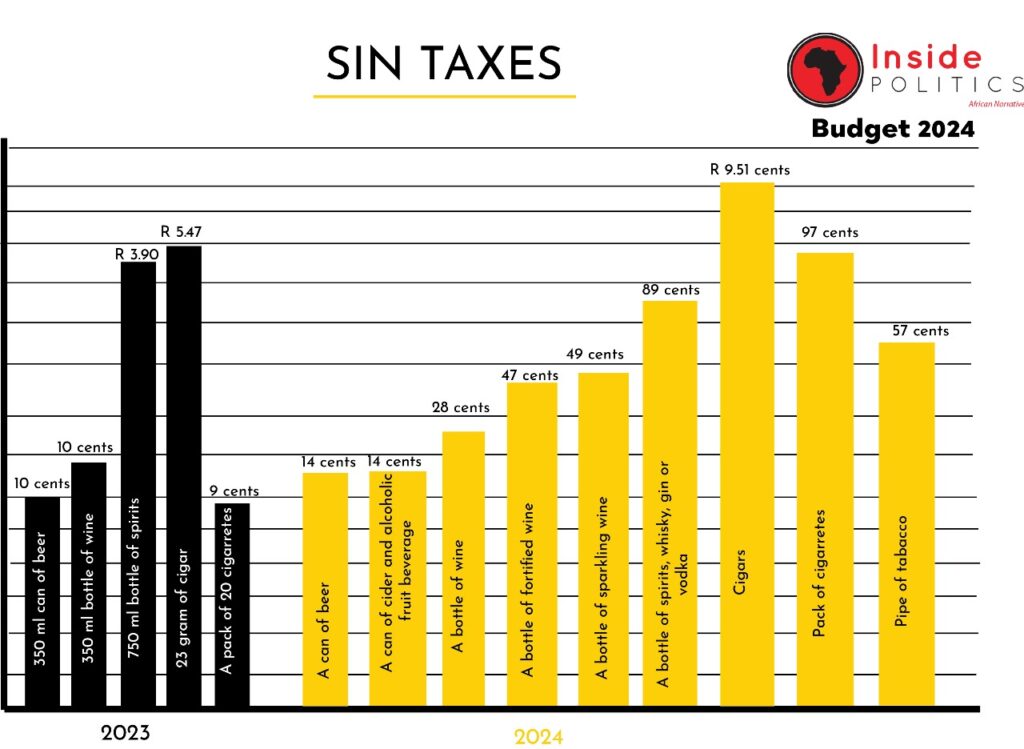

For alcohol products excise duties, above-inflation increases of between 6.7 and 7.2% for 2024/25 was proposed, which meant that:

• A can of beer increases by 14 cents;

• A can of a cider and alcoholic fruit beverage goes up by 14 cents;

• A bottle of wine will cost an extra 28 cents;

• A bottle of fortified wine will cost an extra 47 cents;

• A bottle of sparkling wine will cost an extra 89 cents; and

• A bottle of spirits, including whisky, gin or vodka, increases by R5.53.

In addition, the minister was proposing to increase tobacco excise duties by 4.7% for cigarettes and cigarette tobacco, and by 8.2% for pipe tobacco and cigars, which translated to:

• A R9.51 cents increase for cigars;

• A 97 cents increase to a pack of cigarettes; and

• An extra 57 cents for a pipe of tobacco.

The Minister made reference to a certain Kamogelo Mogane from Soweto, one of the over 2700 South Africans who sent Budget Tips to the Minister, and suggested the introduction of a tax payment for hubbly bubbly, e-cigarettes and other alternatives.

“The country has seen an increase in the number of youth smoking these products and parents are not pleased with this at all,” Godongwana noted and added that the government was intending on tabling an increase of the excise duty on electronic nicotine and non-nicotine delivery systems, known as vapes, to R3.04 per millilitre.

Furthermore Godongwana said in order to address the high levels of illicit tobacco, SARS intended to deploy CCTV and related technologies at licensed tobacco manufacturers, and that thus far investigations and prosecutions have resulted in R10 billion in additional assessments from the key players in the illicit gold and tobacco industry, in an attempt to improve revenue.

INSIDE POLITICS