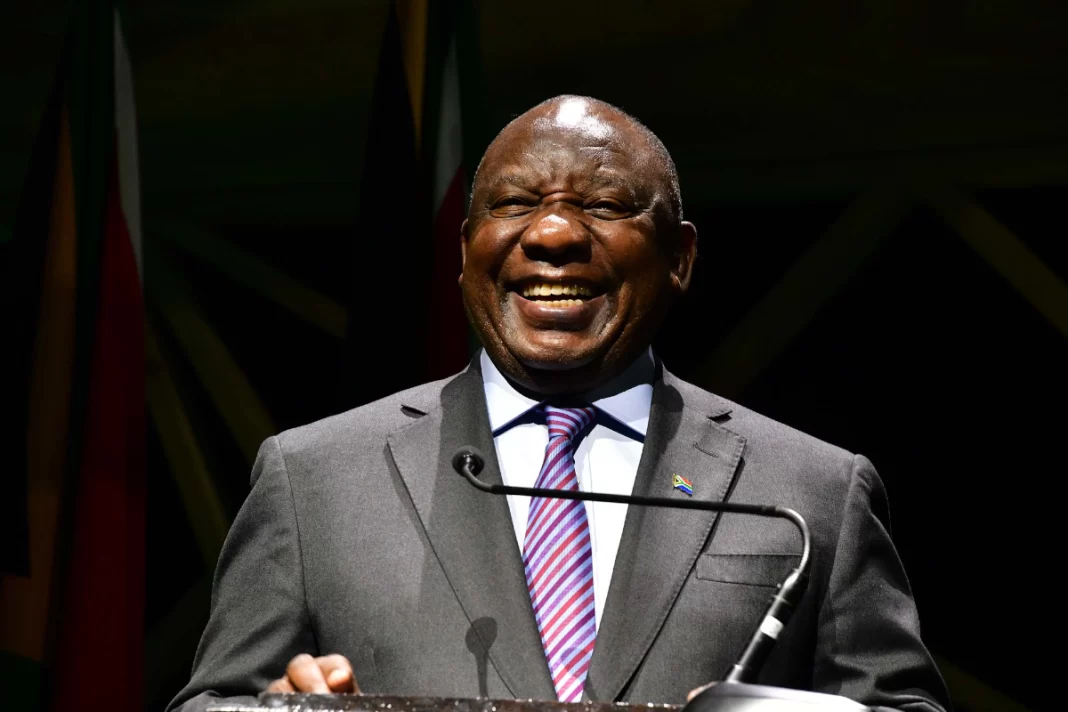

NATIONAL Treasury is budgeting for a bumper payday for President Cyril Ramaphosa and the country’s deputy president.

The budget for the presidency in 2023/24 through to 2025/26 estimates that the president’s salary will increase from R4.2 million (unchanged from 2022/23) to R4.6 million over the period.

The deputy president, meanwhile, is budgeted to see an increase of R100,000 in 2023 to R3.6 million, ramping up to R4.0 million by the end of the period.

It must be noted that the budget estimates are not the confirmed salaries of the president and deputy president, but rather the room given in the budget for these payouts.

Government salaries are proposed by the Independent Commission for the Remuneration of Public Office Bearers – typically in March – which are then approved or altered by the president.

The commission also proposes the president’s salary, but it is up to parliament to approve this.

For example, while the budget made room for a salary of R4.2 million for the president in 2022, after salary freezes in 2020 and 2021 due to Covid-19, he only saw a bump in his pay to R3 million in 2022.

The deputy president, meanwhile, saw his pay climb to R2.9 million, this against the budget of R3.5 million for that year.

Ramaphosa has also been donating half his salary to charities since 2018.

In 2018, he pledged to donate half his salary to the Nelson Mandela Foundation to support early childhood development projects. The foundation confirmed to News24 that the president had made good on his promise and has benefited over the last four years from the donations.

However, the presidency noted that this donation to the foundation would stop in 2022, as other organisations are planned to benefit.

The pay increases – or not – of top government officials will continue to come under sharp focus, particularly in light of the National Treasury’s stated intention to rein in the government wage bill.

While finance minister Enoch Godongwana did not want to get ahead of negotiations with the public sector during his speech on Wednesday, his department is still facing heated backlash from unions for unilaterally pushing through a hike of 3% in the current financial year.

Increasing the salaries of millionaire ministers and government officials while lower earners in the public service are fighting for even an inflation-linked increase would send the wrong message.

During his speech, Godongwana noted that the government’s gross debt stock is projected to increase from R4.73 trillion in 2022/23 to R5.84 trillion in 2025/26.

He added that the public sector wage bill would reach R701.2 billion – surpassing a level he once thought would be borne in 2025.

This is partly due to the additional R14.6 billion it spent to fund wage increases following its unilateral implementation of a 3% increase in October last year – which public servants are still unhappy about.

Unions are still pushing for a higher increase in light of this cost of living crisis in South Africa, and they say this increase is not good enough as it is less than inflation.

However, Godongwana flagged unaffordable public-service wage bill settlements as one of the critical risks to South Africa’s fiscal outlook, adding that stricter controls to manage the public service’s infamously bloated headcount are needed to rein in spending.

Tough times for South Africans

Despite efforts to address the wage bill and government salaries, Treasury cannot escape the reality of the rising cost of living in South Africa.

According to data published by Stats SA, while headline inflation eased in January and is continued to do so – forecasted to average 5.3% in 2023 from 6.9% in 2022 – inflation for key items like food and non-alcoholic beverages (NAB) continues to accelerate.

The annual rate for food across all categories climbed to 13.4% in January – the highest reading since April 2009, when the rate was 13.6%.

On top of this, the persistent energy crisis is a continued drag on the country’s economy, adding even more financial pressures through direct and indirect costs.

South Africa experienced over 200 days of load shedding in 2022, and the country has already seen 53 days of power cuts in 2023 as of 23 February – mostly at higher stages.

The country is currently in the throes of stage 6 load shedding, and energy experts and analysts have warned that stage 8 load shedding will likely hit by the middle of the year.

Load shedding has already cost the country’s economy hundreds of billions of rands. At the same time, the South African Reserve Bank estimates that the current stage 6 will cost the economy as much as R899 million per day.

Business Tech